There is no dearth of options available for credit cards in the market, and every other bank or company has declared that their credit card is the best. The thing is each credit card associated with different banks has a different renewal charge, benefits, and offers included with it. You as an individual will have different shopping preferences and habits from others which might make one credit card more suitable for you than others.

There seems to be a dilemma amongst people who have just joined the workforce and are tempted by the varieties of privileges offered by credit cards. Credit cards are offered in two major types: Cashback credit cards and Reward Points-based credit cards. Cashback Cards offer a certain percentage of cashback when you spend at partner sites or stores. The rewards-based credit card simply offers reward points for your expenses at partner brands.

As you do research before investing in stock markets or mutual funds, you should also scout the market before choosing a credit card, and select the best ones for yourself. Here are a few of such credit cards which are popular amongst the millennials:

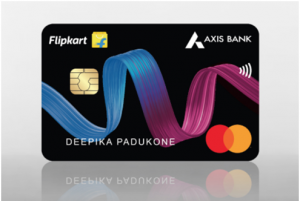

Flipkart Axis Bank Card

This card is beneficial for people who want rewards on shopping online at Flipkart and Myntra. It straightaway offers a 5% cash back on purchases at Flipkart and Myntra, and also offers a 4% cashback on transactions at partner sites. Other than preferred partners, you get a 1.5% cash back for purchases at all other merchants. There is however no cashback on fuel spends.

Even though it is a cashback card, it offers 4 complimentary Domestic Lounge access in one year, which is rare in beginner cards.

The yearly renewal charges stand at Rs. 500+GST, which is waived off on spends greater than Rs. 2,00,000 in a year. On joining you receive Rs. 500 Flipkart voucher which is an added bonus.

ICICI Bank Amazon Pay Card

This card offers you benefits in the form of Amazon Pay Balance, which is a good deal if you shop online through Amazon or it’s partner websites. You can avail of a 5% cashback on all Amazon purchases if you are a prime member and 3% if you are not. A 2% cashback is also awarded for all payments done via amazon pay. You do get 1% cashback on all other merchants. There is a surcharge waiver of 1% on fuel expenses.

The best part is, that the card is totally free. There are no annual charges, no joining fees, and on top of that, you receive a joining bonus voucher.

Standard Chartered DigiSmart Credit Card

This is an all-rounder credit card for all your digital shopping needs. There’s a huge number of discounts on different merchants with a monthly fee of Rs. 49 on this credit card, which is waived off on spending more than Rs. 5000 per month. You have a Buy One Get One offer at INOX for movie tickets, a 20% off on shopping at Myntra and booking tickets at Yatra, a 10% discount on Zomato and Grofers, and also a 15% cashback on Ola. You also can manage your credit card finances and bill payments on the Standard chartered app, which is a breeze to use. Read more about how to avail of this credit card online and the eligibility criteria on the Standard Chartered website.

Simply Click SBI Card

This is again a card targeted towards people who mostly shop online. Hence maximum discounts and offers are given towards online purchases. It offers a 2.5% cashback when you spend at exclusive online partners and 1.25% at other online merchants. Exclusive partners include Amazon, BookMyShow, ClearTrip, FoodPanda, Lenskart, NetMeds, and UrbanClap. It also gives a 0.25% cashback towards offline spending. There is a joining fee of Rs. 499, which includes an Amazon voucher of Rs. 499 also.

HDFC Bank Millenia Card

This is a relatively new card in the market after HDFC Bank decided that it needs to have a new line of cards targetted especially towards the millennials and their expenditure pattern.

It has 8 complimentary airport lounge access in a year and a 1% waiver on fuel surcharge. Right off the bat, it aims to provide good features in a cashback card. There is a 5% cashback on spending at exclusive partner websites like Amazon, Flipkart, bookings via PayZapp, which are applicable on a minimum spend of Rs. 2000. A 2.5% cashback in given on transactions at all other merchants, with a minimum purchase value of Rs. 2000. The card has an annual charge of Rs. 1000 which can be waived off when you spend more than Rs. 1,00,000 in a year.

The list here is not exhaustive and the order of listing does not represent the rank of the credit cards. For getting your first credit card, it is always easier to get it from the bank in which you hold a salary account. Good credit scores are also required for the credit card to get approved.