The housing market can be intimidating for both first-time home buyers and those looking to move up the property ladder. Learning the lingo, navigating the process and deciding which advice to trust may leave you confused. However, it’s all worth it for many the first time they open the door to their new home.

Preparing to buy a home takes time, and there are likely many considerations to make before putting down a deposit. But one you may have forgotten is looking into Permanent Life Insurance. Taking out a life insurance policy could be a smart move for homeowners, and a step towards helping protect their financial future.

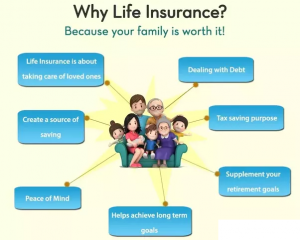

Why life insurance?

There are many reasons why people buy life insurance, with buying a home coming second to starting a family. This makes a lot of sense—home is one of the biggest purchases most people make in their lives, and they understandably want to help protect this asset.

Life insurance is one way that people choose to help safeguard their home. While it may not be pleasant to think about, sudden death or terminal illness could heavily impact an individual or family’s financial standing. The payout from a life insurance policy could go a long way towards covering monthly mortgage payments or paying off the house completely.

However, taking out a policy is just the first step. Homeowners should carefully consider their needs not only when first buying life insurance, but also as time goes on. Changes to your home or general lifestyle may leave you with a policy that no longer fits your needs.

Under insurance: A growing problem

Under insurance is described as an individual or couple not having enough cover to meet their financial obligations in the event of sudden death, terminal illness or serious injury. How researchers calculate under insurance varies from study to study, however, most agree on this general definition. As you can imagine, the amount someone may need would be different for each person or family, depending on factors such as living expenses, debt levels or the number of children they have.

Despite these differences in need, most researchers agree that under insurance is a major issue. In New Zealand alone the problem has created a life insurance gap of $1.95 billion as of 2011. This is true across all age groups, with women more likely to be under insured than men. Research also shows that people in higher income brackets are more likely to be under insured than those earning less.

How under insurance effects home owners

Under insurance could potentially leave families vulnerable to financial hardship. A sudden death or terminal illness might leave someone out of pocket for medical expenses or funeral arrangements, but the situation may go beyond that. Losing a primary or secondary breadwinner could force those left behind to sell the family home if they are unable to keep up with mortgage repayments.

Home owners often find themselves underinsured because they’ve neglected to review their life insurance policy on a regular basis. A policy that met your needs when you first purchased your home may not match your current lifestyle. Upgrading to a new home with a larger mortgage, taking out loans to pay for renovations or investing in property to fund your future could create a mismatch between the life insurance benefit and your family’s financial needs.

Closing this underinsurance gap could be as easy as increasing the amount of cover on an existing policy. However, home owners may want to review the full policy details as well. It may be worthwhile to consider things like optional extras to help provide additional protection in the event of a serious injury or accidental death.

Help protect your home

Life insurance could be a valuable tool for home owners looking to help protect their investment. Providing a safety net for your family—just in case—could help them keep a sense of normalcy during times of change and uncertainty. Before you collect the keys to your new home, think about whether a life insurance policy is right for you.