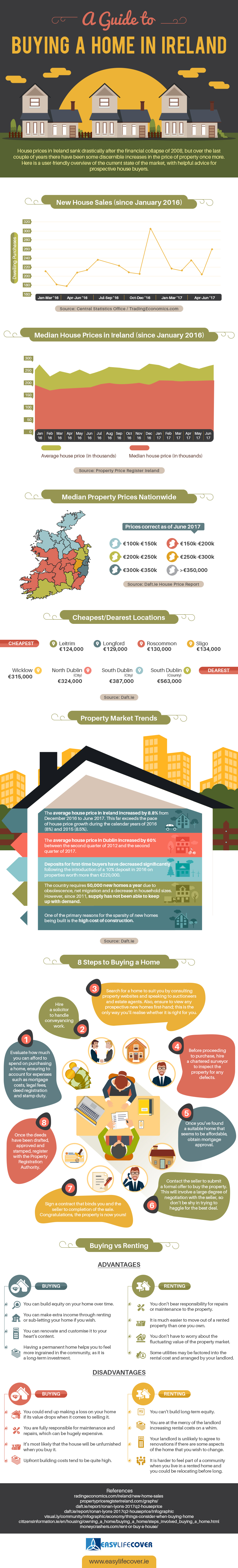

Ireland’s property market plummeted in autumn 2008 as the global credit crunch began to take its toll, but over the last couple of years, there have been evident signs of recovery, with prices steadily escalating across the country. Indeed, the Irish housing market now faces a crisis of a different kind, with supply nowhere near sufficient to cope with the demand for accommodation.

This infographic from Easy Life Cover gives an overview of the current state of the Irish housing market, analyzing median house prices by county and trends in house prices over the last couple of years. It’s interesting to note the gulf in prices based on location; in most north-western counties, you could probably buy a home for less than €150,000, but once you get to the east coast, you’ll most likely need to part with at least twice that amount.

Irrespective of where you choose to buy your home, or for what amount, there are numerous steps that you’ll need to take before you ever get a set of keys into your hand. You’ll need to calculate a realistic budget for a home, inspect what’s on the market, arrange viewings, enlist the services of solicitors and surveyors and obtain mortgage approval, amongst other tasks. Once all that has been done and a price has been agreed, then the deal can be completed and the property registered in your name.

If you’re planning to buy your first home in Ireland in the foreseeable future, the infographic below has some simple and practical information that’s well worth knowing.

עיסוי אירוטי

December 18, 2017 at 10:11 am

Your blog is amazing dude. i love to visit it everyday. very nice layout and content “