In a week’s time, the country can embrace a brand new taxation system, the products and Services Tax (GST), which can dismantle state barriers to make one national market, giving a lift to a bunch of economic and development goals. Lofty goals apart, the switch to one tax from 1 July is ready to present some surprises for customers and businesses.

Consumers can for the primary time get a life of the whole central and state taxes levied on a product, ending a bunch of hidden and embedded taxes they paid to this point.

Businesses can get to grasp if the rise within the headline rate on several things can really be offset by the additional tax credits on raw materials and services, as claimed by the govt.

Headline GST on telecommunication services, as an example, has gone up to eighteen from the V-day service rate nowadays. This has semiconductor diode to issue a couple of potential increases in phone bills, though the government has stressed that tax credits accessible from the service tax paid earlier on spectrum payments can quite offset the speed hike.

The new taxation system is additionally set to check however digitally savvy little traders are measure once it involves filing tax returns.

The government, keen to make sure that GST isn’t inflationary, is within the method of putting in place an Associate in Nursing anti-profiteering authority to stop corporations from passing on any reduction in tax burden to customers. On their half, producers of things like attire and shoes, that have a seasonal market, square measure offloading their entire staging with discounts before July 1.

While most tax consultants dominated out the likelihood of providing disruptions, Associate in Nursing trade govt, World Health Organization spoke on condition of namelessness, aforementioned that some corporations might optimize their stocks within the run-up to 1 July.

The government has already processed that if businesses and traders turn out documents for the taxes paid underneath this system, full credit for such payments is going to be accessible underneath GST. wherever documents for excise or worth supplemental tax payments on the material aren’t accessible from a provider, businesses and traders can get hour credit for the taxes paid on raw materials. This, the authorities believe, can forestall corporations from reducing provides within the weeks before the rollout.

Rolling out GST on 1 July is the result of quite a decade of discussions, tussles among states, and between states and therefore the Union government, instances of provide and take, lobbying and compromise. The highlight of the reform is the creation of a federal tax establishment, the GST Council, that has state ministers as members and therefore the Union minister of finance as chairman and provides each state with a say within the country’s tax policy.

A seamless market of over a billion individuals and eight million registered tax assessees paying one tax for products and services is probably going to travel a protracted method in achieving what the govt has been attempting to try to do through varied measures—promoting the producing sector, boosting exports, making additional jobs, up the investment climate, scaling down nonpayment and lowering the compliance price to businesses.

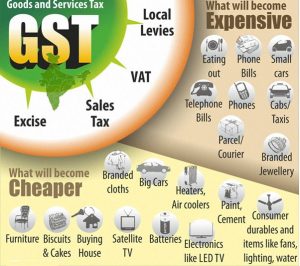

Besides transparency, consumers are likely to benefit from a lower tax burden on some products and services. Lower indirect taxes will also address the regressive nature of this levy which affects the rich and the poor alike, unlike taxes on income which are based on an assessee’s ability to pay.

For businesses, the elimination of multiple levies and the creation of a single market with fewer tax rates and fewer tax exemptions will improve the ease of doing business and reduce avoidable litigation. A large part of the tax litigation in India is around tax exemptions.

However, the GST that is ready for implementation is far from ideal. The guiding principle for the government while trying to secure consensus amid competing interests of various stakeholders was that it is better to have a good GST instead of waiting endlessly for the best one. From the concept of an ideal GST of low tax rate with few exemptions initially considered, the final form has four rates—5%, 12%, 18% and 28% for goods and services—with some items in the highest slab attracting an additional cess. Most of the items fall in the 12% and 18% slabs depending on the current tax burden on them.

As of now, the Centre taxes the production of goods and the supply of services, while states get to tax the sale of goods but not supply of services. Real sex with Child In GST, this barrier is removed and both the Union and state governments get to tax the entire value chain of goods and services, increasing compliance, explained V.S. Krishnan, adviser (tax policy group) at EY India and a former member of Central Board of Excise and Customs.